Smart Strategies for Saving Money at Online Casinos

Smart Strategies for Saving Money at Online Casinos

Understanding Emotional Intelligence in Relationships

Understanding Emotional Intelligence in Relationships

How To Use A Women’s Apparel Promo Code For Your Next Purchase

How To Use A Women’s Apparel Promo Code For Your Next Purchase

DIY Home Renovations: Saving Money On Home Upgrades

DIY Home Renovations: Saving Money On Home Upgrades

Alineaciones de Santos Laguna Contra Club América: Insightful Match-Up Analysis

Alineaciones de Santos Laguna Contra Club América: Insightful Match-Up Analysis

Let's Talk About Money

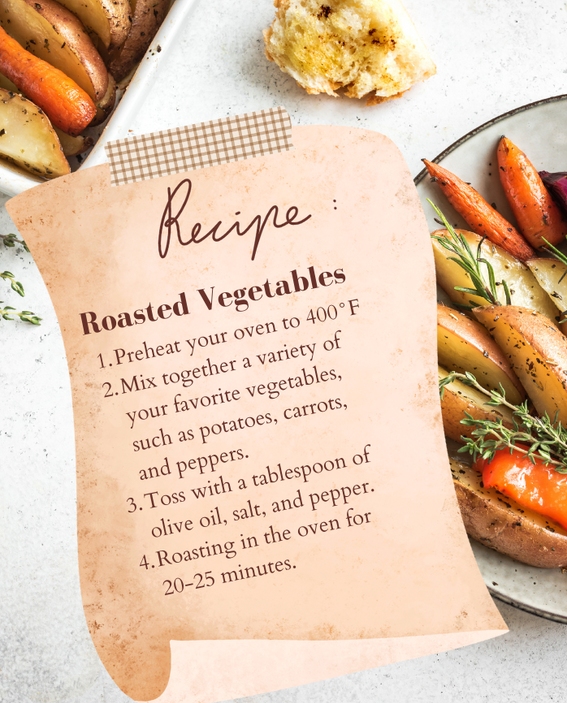

Let's Cook

Plant-Based Smoothies and Bowls: Healthy Starters for Your Day

The best way to kick start a day is by taking a healthy, tasty, and refreshing smoothie early in th…

6 Fruit Based Vegan Desserts You’ll Love

It’s always nice to have dessert after a meal, but it isn’t always good for us. By substituting sho…

Basic White Bread Recipe

Many bread choices from the store contain soy ingredients. We have a soy allergy in our family but…

Cheesy Crock Pot Chicken (3 Ingredients)

On busy days my crockpot is my best friend. With school starting back up and extracurricular …

Homemade Apple Butter in the Crockpot (No Sugar Added)

No Sugar Added Apple Butter (AKA Naked Apple Butter) Each year my grandparents (or as my kiddos cal…

Inside Out Chocolate Strawberries

We eat a lot of strawberries when they go on sale! We eat them all day for snacks, sides to m…

Dump Cake Recipe (Only 4 Ingredients)

This truly is a DUMP cake. As in, I used what I found, what sounded good and dumped it in the…

What Our Readers Say About Us

Read More

Absolutely love the insights and practical tips I've found on lovinglifelivingonless.com! This website has become my go-to resource for embracing a more intentional and fulfilling lifestyle.

Read More

The layout and design of the website are clean and user-friendly, making it easy to navigate through various topics. The step-by-step guides and actionable advice have been incredibly helpful in implementing new habits, such as decluttering my space and making more conscious purchasing decisions.

Read More

I would highly recommend lovinglifelivingonless.com to anyone looking to make meaningful changes in their lifestyle. Whether you're aiming to reduce clutter, save money, or simply cultivate a sense of contentment, this website offers a wealth of valuable information

Previous

Next

Don't Miss

Let's Travel

Family Travel Tips to Make it Simple & Affordable

Do you love to travel, but struggle to get away because of the cost of taking a vacation? Traveling…

Butterfly Wonderland

If you follow me on Instagram or Facebook you got to see me posting some photos…